Adding taxes and fees to TeamUp

Taxes and fees can be applied to any purchase made through TeamUp. They will be itemised on receipts and will be accessible via reports.

Let's take a look at how to set them up!

🎥 Watch the tutorial

📕Read the tutorial

To create a tax/fee, head to Settings >> Payment >> click 'Create a Tax/fee'.

Now complete the values as prompted, and save your new Tax/Fee:

You can also update the information included on receipts sent to customers:

⚠️ Important step!

By default, taxes and fees set here are automatically added to applicable purchase prices.

This means the gross price is increased when this fee is added i.e if the price is £100 and a tax of 20% is added, the new price becomes £120, so you'll need to update your prices on all applicable purchase types right after adding the fee, if required.

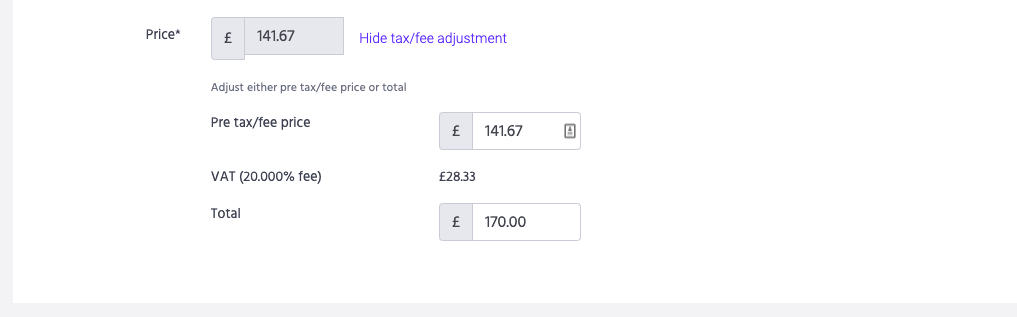

This is made easy using our fee calculator which you'll find anywhere you can update pricing i.e. classes, memberships. Here you'll simply enter the total price you want the customer to pay and the system will work out the rest. In the below example the total price the customer pays is £170 and the pre tax price is 141.67.

See the jump to guides below for steps on how to update pricing on your classes and memberships.

Do let us know if you need any assistance here.

Jump to:

How to change the prices on your classes

How to change the price on a recurring membership for new customers

How to change the price on a recurring membership for existing customers